Back in March 2015, we wrote that you shouldn't count on the Fed to raise rates in 2015 because of deflation and slowing growth. In September, we wrote that recession is just around the corner in the US.

Therefore (unlike the street), we were not surprised by Friday's weak job report where job growth was less than expected. Not only that, wages disappointed, revisions to August's report were bad, and the participation rate fell to a new 38-year-low.

It's time for investors to stop listening to the media noise and if you look at the the actual data, you can only reach one conclusion: the Fed will not raise rates in 2015 or 2016, but they will soon turn 180 degrees and start talking about the next round of QE (quantitative easing) and/or negative rates.

Let's take a look at 3 reasons why the data dependent Fed can't raise rates anytime soon.

#1 Jobs

The Fed has been pretty happy with the overall jobs data with the unemployment rate at 5.1%. However this headline number only tells part of the story. The labor force participation rate continues to decline falling to 62.6% in September which is a 38-year low. Research firm Challenger Gray reported that there was a surge in job cuts in the third quarter. US-based employers announced plans to shed over 58 thousand jobs in September, a 43 percent increase from August. In the third quarter, some 205,759 job cuts were announced, making it the largest job-cut quarter since the third quarter of 2009, when planned layoffs totaled 240,233.

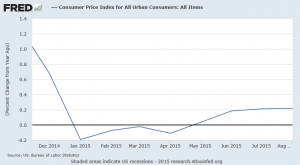

#2 Deflation

The Fed targets 2% inflation. In the first quarter, the CPI was negative. Yes deflation, not inflation. The weakness in oil prices was not transitory and isn't likely to get any better with slowing growth around the world. In August, the CPI printed a weak 0.2%. In Europe, their CPI fell back into negative territory in September and there are increasing calls for more stimulus in the Eurozone.

#3 Slowing Growth

At the FOMC's September meeting, the Fed reduced their 2016 GDP growth projection range to 2.2-2.6%, down from 2.4-2.7% in June and 2.6-3% in December 2014.

The Federal Reserve Bank of Atlanta's GDP model is forecasting less than 1% growth in the third quarter of 2015.

Bottom Line

Given this weak data across the board, the Fed will likely change their talking points over the next few FOMC meetings. Investors should expect the conversation to change from rate hikes to the possibility of easier monetary policy. Whatever the case, the slowing growth prospects in the US and abroad will continue to put pressure on equities which are overvalued.

When do you believe the Fed will raise rates? 2015? 2016? 2017?

“Janet Yellen – Caricature” by DonkeyHotey is licensed under CC BY 2.0

By