Warning: this is an in-depth review of the Pacific Index Choice Annuity. Many annuity critics point to complexity as being a major negative for this asset class and Pacific Life doesn't dispel this criticism. So buckle up and let's dig in.

The annuity business has grown in popularity as investors, especially those nearing retirement, look for options to protect themselves from stock market volatility and give them a decent income stream in retirement. With over $200 billion in annual sales, the annuity industry is big business with lots of salesmen trying to persuade you to make a purchase.

Today I will dig deep into one of the best-selling indexed annuities for the 4th quarter of 2013. Sales of indexed annuities, a fixed annuity that provides a minimum guaranteed rate of interest combined with an interest rate tied to the movement of an index, increased to $39.3 billion in 2013, a 17% gain year over year. This is the biggest percentage increase of any form of annuity.

You will often hear that annuities are sold, not bought. This is exactly why I will go in depth into some of the most popular annuities because there is shockingly little information available about them. Most of the information comes from the companies that sell the annuities and they gloss over the fees, risks and downsides. More importantly, annuities have grown into extremely complex instruments which even the most seasoned professional may have trouble deciphering. Indexed annuities, often the black sheep of retirement products, have a history of being so complex that they were a focal point of litigation and regulatory action in the 2000s. While the negative attention led to a change for the better among the carriers, indexed annuities are still complex and difficult to truly understand.

A Perspective That You Can Trust

I am writing this blog from the perspective of a curious analyst. I am totally impartial as I am a fee-only registered investment advisor. I hope to bring a unique perspective to this topic drawing on my years of experience analyzing companies as a research analyst. I’ve met with hundreds of company CEOs and CFOs, including Steve Jobs and Richard Branson, and I will use my analytical skills to break down these complex instruments into something easier to understand.

While many investment professionals hate annuities, I do not believe that they are all bad and some of them can make sense as a small part of your investment portfolio. Annuities should never, I repeat never, be the large majority of your portfolio because of their lack of liquidity which is one of their biggest drawbacks.

Issuer Review: Pacific Life

It is important to look at the issuer of the annuity first because annuities are NOT a guaranteed investment of any sort. This is important to note so I will say it one more time. Annuities are NOT guaranteed. They are only backed by the ability of the issuing insurance company’s ability to pay. Therefore if the issuer goes bankrupt, you are at risk of losing everything! On the ninth page of the prospectus, it states clearly:

Pacific Mutual Holding Company is the parent company of Pacific LifeCorp, which is the parent company of Pacific Life Insurance Company. Offering insurance since 1868, Pacific Mutual sells life insurance, annuities, mutual funds, retirement solutions, real estate investments, aircraft leasing and reinsurance services.

Pacific Life receives very good credit ratings from all the major agencies. Fitch rates it A+ (Strong), Moody's rates it A1 (Good) and S&P rates it A+ (Strong).

S&P states that “Pacific Life's competitive position is very strong. The company has been very successful in penetrating the highly competitive affluent marketplace because of its unique and diverse distribution network and positive brand recognition within its target market. We consider Pacific Life's capital and earnings to be strong.”

- The company still has a sizable in-force block of older business, exposing it to volatile equity markets and dropping interest rates.

- Most of Pacific Life's earnings sensitivity is in its Variable Annuity line, where the combination of lower fee-based income, increased liabilities associated with guaranteed living benefits, and increased hedging costs led to a sharp deterioration in performance mid-year 2011…

- Pacific Life's risk position is intermediate, highlighted by the modestly elevated commercial mortgage exposure in its investment portfolio. Pacific Life has a concentration of very large loans, many of which are of types we believe are most vulnerable to elevated losses in a weak economy.

- The most severe risk arises from equity-market exposure from its Variable Annuity business.

Annuity Review: Pacific Life Pacific Choice Variable Annuity

Maximum age for initial purchase: 85

Minimum initial premium: $25,000 (Qualified and Non-qualified)

Maximum: Total purchase payments greater than $1 million require home-office approval

Rider fees: 0.75% (maximum charge of 1.5%) for Enhanced Lifetime Income Benefit Rider

Website: http://www.pacificindexchoice.com/microsite/pic.html

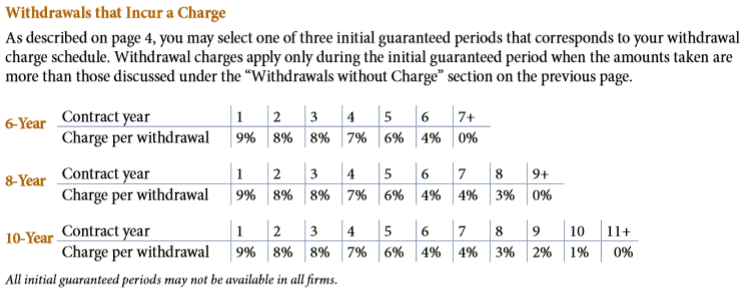

Beware of Surrender Fees

For this annuity, there are varying surrender periods and charges depending on how long you choose to guarantee your cap rates for your index crediting options. As is typical with annuities, the fees are very high in the first few years so your invested assets are essentially illiquid in those early years. Here are the details from their brochure:

I believe surrender fees are one of the worst features of annuities. These are huge lockup fees and if you need the money, they sock it to you. This is why annuities should NEVER be a significant part of your investment portfolio because they are essentially illiquid for many years. Unless you are positive you will not need access to these funds, then annuities are NOT for you.

The Pacific Life pitch as per their brochure

Pacific Life highlights these points:

- A guarantee to never lose principal due to market performance

- The potential for growth through the Interest-Crediting Options — a Fixed Account Option and/or six Index-Linked Options

- An immediate credit enhancement.

- Three initial guaranteed periods based on retirement time horizon

- An optional withdrawal benefit, available for an additional cost, which offers an 8% Annual Credit if no withdrawals are made in the first 10 years.

How will you likely be pitched this annuity?

This indexed annuity (also called an equity-indexed annuity, fixed-index annuity or hybrid annuity) will likely be packaged around two main components:

1. Principle protection with upside potential from their attractive index choices

2. Guaranteed income (at an additional cost) with the GMWB rider

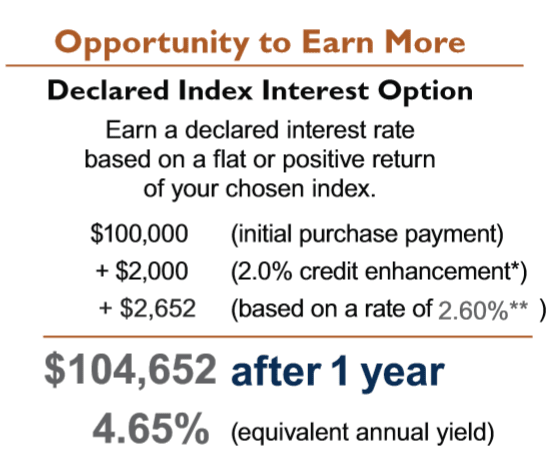

Here is the example straight from Pacific Life's marketing material

I find this example misleading for potential buyers. Yes, the first year return can be 4.65% however the 2% credit enhancement is a one-time event. I feel like aggressive sales people will over promise returns using this yield figure of 4.65%. It is important to know that this isn't what you should expect over the life of this annuity. The truth is that whatever index crediting option you choose, your long-term expectations should be for a yield of 2-3% and nothing more.

Please do not trust anyone that promises anything above 2-3% for this product. It is just not going to happen. Trust your instincts and run if any agent is selling you the dream of 5-6%+ returns or more.

Let's dig into this annuity so you have a better understanding of the nuts and bolts…

Interest Crediting Options

It is important to understand that you are not investing in the underlying securities of any index. With index annuities, you are not making investment choices like a variable annuity. Your interest crediting options are mathematical formulas that the insurance company is using to attract you into buying xyz annuity. The insurance company invests your money in whatever they choose (likely diversified, conservative investments). They have to earn a return higher than their mathematical formula (or interest crediting option) so they can pay you, their sales force, marketing, operations, etc. This is why index annuities will only generate low single-digit returns.

For the Pacific Choice Annuity, you may select from either the fixed account or 2 indices (S&P 500 or MSCI ACWI). To make it a more complex, you have three different crediting methods: 1-year point-to-point, 2-year point-to-point and declared index interest options. The cap rates are different depending on whether you choose a 6, 8 or 10 year guarantee period and also on how much you invest. Click here for the current rates as of April 1, 2014. So let's dig a bit deeper into your choices.

As of April 1, 2014, the Fixed interest allocation is currently paying 1.30%. I'm not sure why anyone would want this option. You can buy a 5-year Treasury Note and earn 1.63%. You can beat the fixed account on your own.

So onto the Indexed interest options. Many salespeople may sell you on high returns but none of these options will deliver more than 3% returns. If someone is promising higher returns then you need to find a more honest agent. Whatever option and crediting method you choose, you will likely make around 1-3% over the long term. I will illustrate this for you.

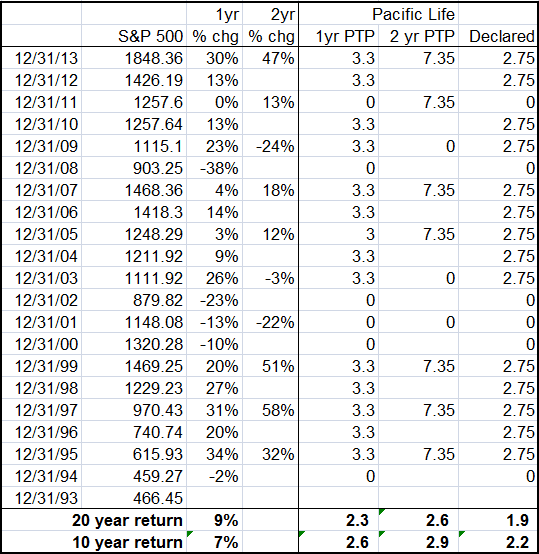

For this illustration, I am using the most generous current cap rates that you can earn as of April 1st. This means I am using a 10 year initial guarantee period and assuming that the investment is over $100,000. If you choose a shorter guarantee period (and shorter surrender period) and/or invest less than $100,000, then your returns would be reduced further. So here are the results using the different interest crediting options.

As you can see, if you chose the S&P 500 index, then your annual returns varied from 1.9-2.9% over the last 20 years. I didn't bother with the MSCI ACWI because it underperformed the S&P in just about every time period that I could think of. If you are satisfied with these types of returns then it is fine. I just don't want you to expect more because you will surely be disappointed.

If you have additional questions about this section, please submit a question using our secure form. We will answer your questions within 24 hours via email. No strings attached, just a little free help to point you in the right direction.

Who should buy this product?

In summary, the Pacific Index Choice Annuity is something to consider for someone that doesn't want to worry about market volatility, won't need access to their money for at least 10 years and is happy with low single-digit returns of 1-3%. The annuity can make sense for an extremely conservative investor who is looking for guaranteed income with no market risk. If you are happy with low investment returns and a guaranteed income stream, then this product may be acceptable for you. Be sure to evaluate how it fits into your entire investment strategy and how it will help you reach your financial goals.

One of the most important things for investors is that the roll-up rate is not the actual return and neither is the lifetime withdraw rate the actual return. In no way will any indexed annuity produce 8%+ returns which a lot of uneducated agents will toss around when trying to sell them.

In the end, all of the interest crediting options will pay roughly 2-3% over a full market cycle. If this gets too far out of line, Pacific Life will adjust the caps because they can't afford to pay more. Don't buy into any sales pitch that is promising rates of return of 8% or more. It just isn't possible to generate 8% returns with no downside risk. If anyone promises you even 5%+ returns for this annuity, don't just walk away, run for the door and find a new advisor. For Pacific Life to pay 5% on this annuity, they would have to earn 8-9%+ on their own investment portfolio so they could pay you as well as their salespeople, marketing and overhead, not to mention to earn a profit themselves. Commissions are very lucrative for agents selling this annuity so be sure that you make the right decision for you, not for their benefit.

Have questions about this Annuity?

If you're considering this annuity and have additional questions, feel free to reach out. You can contact us via our secure contact form. We will answer your questions within 24 hours via email. No strings attached, just a little free help to point you in the right direction.

Have you purchased this annuity or are you doing your due diligence? Please share your experience in the comments section below.

“Annuities stock photo” by lendingmemo_com is licensed under CC BY 2.0