The investment business can be funny. We all know that there are economic cycles and that the stock market goes through times of boom and bust. However, the conventional “”buy and hold”” approach says that you should not touch your portfolio regardless of what is going on in the world. You are encouraged to “”stay the course”” with no regard to asset protection.

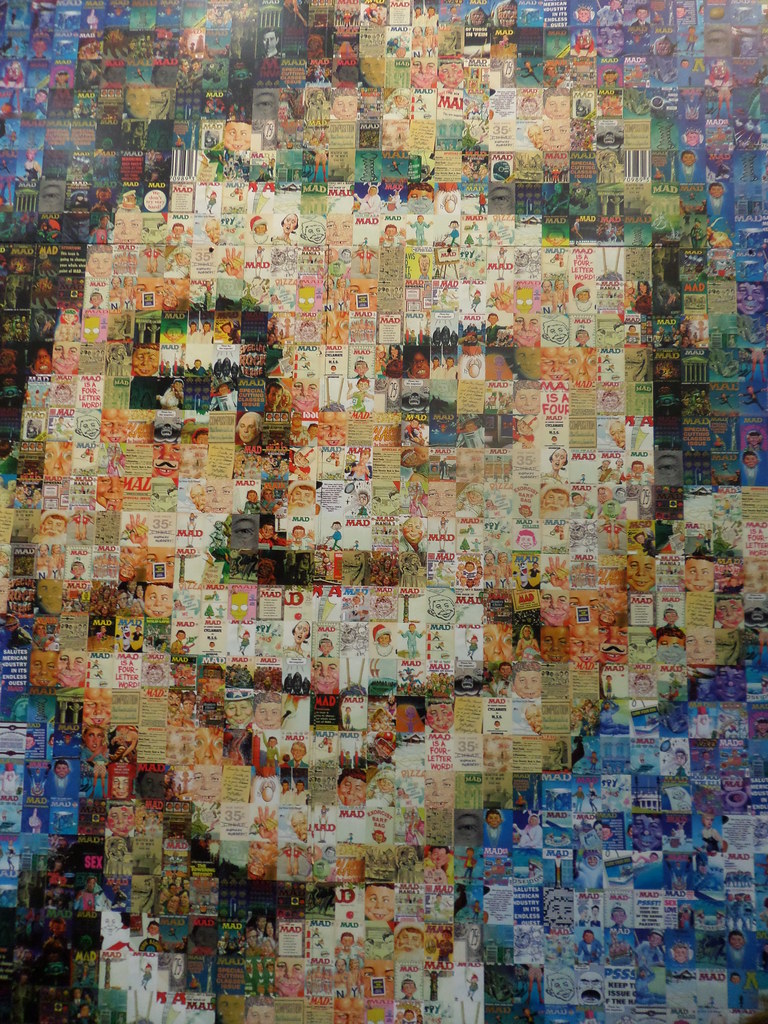

What, Me Worry?

Earlier this month, Al Feinstein, the soul of Mad Magazine from from 1956 to 1985 passed away at age 88. In his second issue as editor, Mr. Feldstein put a freckled, gaptoothed, big-eared young man on the cover, identifying him as a write-in candidate for president campaigning under the slogan “What — me worry?” Alfred E. Neuman went on to grace the cover of all but a handful of the magazine's 500 issues. His slogan reminds me of the popular “set it and forget it” portfolio approach so prevalent today. Unfortunately, many people cannot afford to ride the market down through another 2008. In fact, even our nation's largest pension funds are challenged to figure out ways to lessen volatility because a potential bear market in the equities would worsen unfunded liabilities.

What to Worry About

Keith McCullough of Hedgeye Risk Management recently interviewed best-selling author Jim Rickards who wrote Currency Wars: The Making of the Next Global Crisis andThe Death of Money: The Coming Collapse of the International Monetary System. If you own stock, bonds, real estate, currencies, or precious metals, I think it is worth digesting this 43 minute conversation. Even for eternal optimists, it is good to hear what concerns are brewing out there. Or at the very least, forward it to your investment professional because it is his/her job to worry about these things on your behalf.

Highlights:

- 00:58 Keynesian Economics = Junk

- 3:00 The Fed Uses The Wrong The Model

- 5:50 Think About Risk The Right Way

- 10:17 Rickards Discusses His Two Books Currency Wars: The Making of the Next Global Crisis and The Death of Money: The Coming Collapse of the International Monetary System

- 15:00 2014 Is Worse Than 2008

- 16:55 Catalysts For Collapse: Failure To Deliver Gold and More

- 20:16 Global Impact of Liquidity Issues in the U.S.

- 22:35 McCullough: My Biggest Market Fear

- 26:13 Why Yellen Is Worse Than Bernanke

- 31:40 Will The Next Big Bailout Be The Fed?

- 33:00 Panic in Europe and Why Draghi Won't Sell Gold

- 38:00 U.S. Inequality Perpetuated by Yellen

- 39:40 The Princeton Economic Department Should Be Quarantined

- 41:55 People Don't Trust Wall Street

Read our other articles:

- Don't Let Market Bubbles Hurt Your Portfolio

- Asset Protection 101: Knowing When to Sell

- Asset Protection 101: When Buy and Hold Fails

Do you have a “what, me worry” portfolio? Are you prepared to stay the course or are you looking for a different approach?

“Alfred E Newman mosaic in DC booth” by Joe Crawford (artlung) is licensed under CC BY 2.0

By