Your 401(k) could make you a millionaire. By making small, regular investments starting in your 20s or early 30s, your savings will grow tax-free for 30 to 40 years. Unfortunately, people tend to procrastinate because they are focused on bills that are due today and the things they want right now. We human beings are notoriously bad at wrapping our minds around far off events.

When it comes to investing, time is a big advantage. Here are three reasons why.

More Contributions

You may have heard of personal finance guru David Bach's Latte Factor. It is the simple idea that small trivial things we spend on everyday can add up to an extremely large amount over time. Rather than buying a $4 latte every morning, instead contribute a percentage of every paycheck to your 401(k) plan. The earlier that you start, the more contributions you are setting aside per pay period toward retirement. You'd be surprised how little amounts can become significant over a year and even more surprised at how much accumulates over 10+ years. Another benefit is that contributing to your 401(k) reduces taxable income.

Employer Match

If I were to ask you if you would turn down free money, it's a safe bet that you'd say no. But that's exactly what many Americans do when they fail to take advantage of matching retirement funds that their employers offer them. In fact, one in three Americans has $0 saved for retirement! Company contributions are like guaranteed investment returns that amplify your own contributions. Always take full advantage of your company match so you are not leaving money on the table.

The Power of Compounding

The secret behind amassing signficant wealth in your 401(k) account is compound interest which essentially means “interest on interest.” Few people get excited about compounding interest, especially today with near zero percent interest rates, but more people should. This is the secret sauce!

If you're saving $300 per month, that's $3,600 in a year. Over time though, your money grows so in year 2, if you saw an increase of 5%, that $3,600 is now $3,780. Combine ongoing contributions and appreciation and you start to see exponential growth over time.

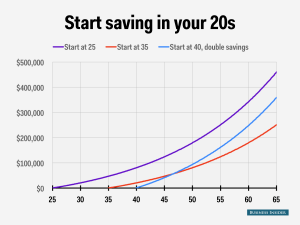

Business Insider did an illustration of three investors:

- One investor who starts saving $300 per month at age 25

- A second who waits ten years and starts saving $300 per month at age 35

- A third investor who waits longer and starts saving at 40, but in order to try to catch up saves $600 per month

Assuming a conservative annual rate of return of 5%, here's what happens to the three investors' accounts:

As you can see, the power of compound interest is just that — powerful. The earlier you start, the longer you have to potentially grow your nest egg. So invest early and invest often.

Have you started participating in your 401(k) plan? When did you start?

“401K” by Got Credit is licensed under CC BY 2.0

By