When we started the Runnymede blog a couple of years ago, our number one priority was to educate investors about investments and finance. Since then, we have received hundreds of questions. We take pride in answering each and every one of them.

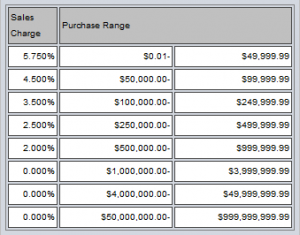

Last week, I reviewed a woman's investment portfolio who asked, “Are my fees huge for the investments that I have?” After a bit of quick research, I was shocked by the results. In fact, it nearly made me sick to my stomach. Her retirement accounts held five mutual funds and all of them had outrageous front-end load fees. Here is the shocking truth:

Given the size of her investment, she paid a ridiculous 5.75% front-end load fee on all her mutual funds. That means on day 1, she already had a loss of 5.75%. Just to put this in perspective, if she invested $40,000 into each of five mutual funds, that $200,000 that she wanted to invest? It instantly shrank by $11,500. She could have used that money for her kids' college expenses or an entire year of her mortgage payments!

“Front-end load” are fees that typically go to the brokers that sell certain mutual fund shares. However this isn't the only way brokers are compensated for recommending funds. Less visible annual 12b-1 distribution charges also flow to brokers. In this case, another 0.25% per year. This is in addition to the mutual funds underlying 1.0-1.5% management fees.

Say no to frond end load mutual funds

In today's investing world, you should never have to pay a sales load. No-load mutual funds are common place. In addtion, exchange traded funds will never charge a load fee. Princeton University professor Burton Malkiel advises, “In no event should you ever buy a load fund. There's no point in paying for something if you can get it free.”

If your broker is selling you a front or back-end load mutual fund, you may want to look elsewhere for investment advice. There's evidence that brokers, who lack a fiduciary standard, offer worse advice. A 2009 study led by Harvard Professor Daniel Bergstresser looked into detail at funds sold by brokers from 1996-2004 and he found they lagged other funds even before taking into account commission costs.

If you want to know if your mutual fund charges excessive load fees, I recommend going to FINRA's fund analyzer which is free to use and is a simple tool to quickly look under the hood of your mutual fund investments. Just say NO to sales loaded mutual funds!

“JUST SAY NO” by marc falardeau is licensed under CC BY 2.0

By