Runnymede has increasingly been serving as a fiduciary advisor to companies' 401(k) plans so I continue my series of articles on how to tune up your retirement plan. The intended audience is the company and its trustees that sponsor the plan but participants are also advocating for better plans. It is our hope to help employers optimize and better manage their retirement plan. In doing so, we seek to help employees achieve their goal of successfully preparing themselves for retirement.

This week, I want to help you to decipher mutual fund share classes. By far the largest component of 401(k) plan fees and expenses are those associated with managing plan investments. Moving to less expensive funds is an action item that can save money fast and have a huge impact over time.

What are Mutual Fund Classes?

As an investor, you may have heard about Class A, Class B, Class C or other classes of mutual fund shares. A single mutual fund, with one portfolio and one investment adviser, may offer more than one “class” of its shares to investors. For example, we will look at the JP Morgan Large Cap Growth fund that comes in 8 different share classes. Remember, each represents the same fund strategy and portfolio holdings but the fees and expenses charged to the investor are very different.

| Fund Name | Symbol | Net Expense Ratio |

| JPMorgan Large Cap Growth A | OLGAX | 1.05% |

| JPMorgan Large Cap Growth C | OLGCX | 1.55% |

| JPMorgan Large Cap Growth Select | SEEGX | 0.90% |

| JPMorgan Large Cap Growth R2 | JLGZX | 1.40% |

| JPMorgan Large Cap Growth R3 | JLGPX | 1.15% |

| JPMorgan Large Cap Growth R4 | JLGQX | 0.90% |

| JPMorgan Large Cap Growth R5 | JLGRX | 0.70% |

| JPMorgan Large Cap Growth R6 | JLGMX | 0.60% |

The Impact of Fund Fees Over Time

As you can see in the table above, the fees charged vary widely. The difference between the most expensive class C-shares and least expensive class R6-shares is 0.95%. Remember, investment-wise these funds are the same — only the fees differ.

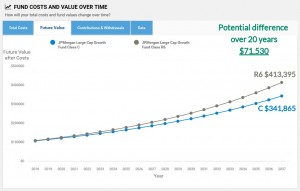

Using FINRA's Fund Analyzer tool to illustrate, take a look at the potential impact a plan participant could see between owning the C versus R6 shares. On a $100,00 investment, assuming an 8% rate of return over 20 years, the potential difference to the investor could be $71,530!

Multiply this difference across 200 employees and the total assets of your retirement plan, and the importance of offering the lowest cost funds becomes even more meaningful.

Check Your Fund Lineup

The alphabet soup of mutual fund share classes can be overwhelming. Here is a table that can help you perform a quick assessment of your fund choices. Sometimes, share classes vary depending on the fund company but I've applied general rules of the thumb to the following table.

| Higher Cost | Lower Cost |

| Class A | Insitutional or Class I, X, Y, Z |

| Class B | Class R5 |

| Class C | Class R6 |

| Class T | |

| Class Adv (advisor) | |

| Service or Class S | |

| Class R1 | |

| Class R2 | |

| Class R3 | |

| Class R4 |

Fiduciary Responsibilty

Reviewing your fund fees and making sure that you are offering the lowest cost fund choices not only benefits participants retirement savings, it mitigates plan trustees' liability. The law requires that fees charged to a 401(k) plan be “reasonable” rather than setting a specific level of fees that are permissible. Fees will vary depending, in large part, on the size of your 401(k) plan, but reviewing and lowering fees as part of your process goes a long way to demonstrate to the Department of Labor that plan trustees are fulfilling their responsibilities.

Photo by JESHOOTS.COM on Unsplash

Helpful Links

Do you understand mutual fund share classes? Do you know if you can substitute lower cost funds into your lineup?