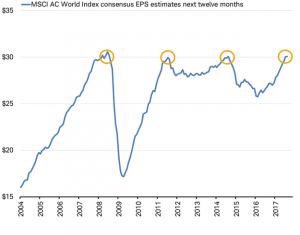

Interestingly, it was a different region that drove world earnings to the $30 level each time.

- In 2008 it was Europe and the emerging markets that contributed the most to lifting global earnings to $30.

- In 2011, the full rebound in the United States and emerging markets were the drivers back to $30.

- In 2014, Japan's rebound to its prior peak offset weakening emerging markets to reach $30 again.

- In 2017, the current rebound to $30 was supported by a rise in all regions.

This time is notably different as all regions are back on the path of growth and this trend is expected to continue in 2018. The IMF forecasts global growth to accelerate next year. This should be good news for stocks and a reason to remain bullish for the short to intermediate term.

Header photo from Unsplash Pascal Habermann