Whenever markets reach new highs, it is inevitable that people begin to ponder if this is a top or even worse, a bubble. This led the WSJ to ask famed investor Jeremy Grantham point blank, “Is the US market in a bubble or is it different this time?” His response is certainly worth a few minutes of your time.

“It doesn’t have the characteristics of a bubble. I think a simple way of defining a bubble is that it has to have nearly perfect fundamentals which have to be irrationally extrapolated with considerable euphoria around. Remember the style from 2000, Japan in ‘89, or the US housing market (house prices will never decline), or 1929 in the old days was a classic. We have almost none of that euphoria. We also have very imperfect fundamentals.”

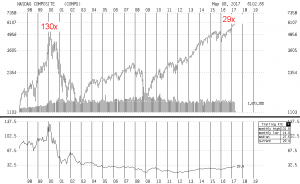

I agree that this isn't a repeat of 2000 despite the NASDAQ finally trading above its previous high of 2000. The two periods are vastly different. Back then, the forward PE was 130x and the majority of new tech IPOs had no earnings at all and were only in business for a year or two. Today, the companies that survived the tech bubble have developed into mature and profitable businesses. Furthermore their PEs stand at 29x which is a similar PE for tech for more than 10 years.

Watch the full interview here:

“Robert-Shiller-ValueWalk-popping-bubbles-bubble-danger-markets-Robert-J-Shiller” by ValueWalk is licensed under CC BY-SA 2.0

By