According to the team at DataTrek, here is a progression of Q1 estimates:

- On January 4th, analysts had 2.9% earnings growth/7.3% revenue growth baked into their Q1 2019 numbers.

- On January 11th, estimates were cut to 1.8% earnings growth/6.2% revenue growth

- On January 18th, estimate were revised down further to 1.1% earnings growth/still 6.2% revenue growth

- Now, expectations are for 0.7% earnings growth/6.1% revenue growth

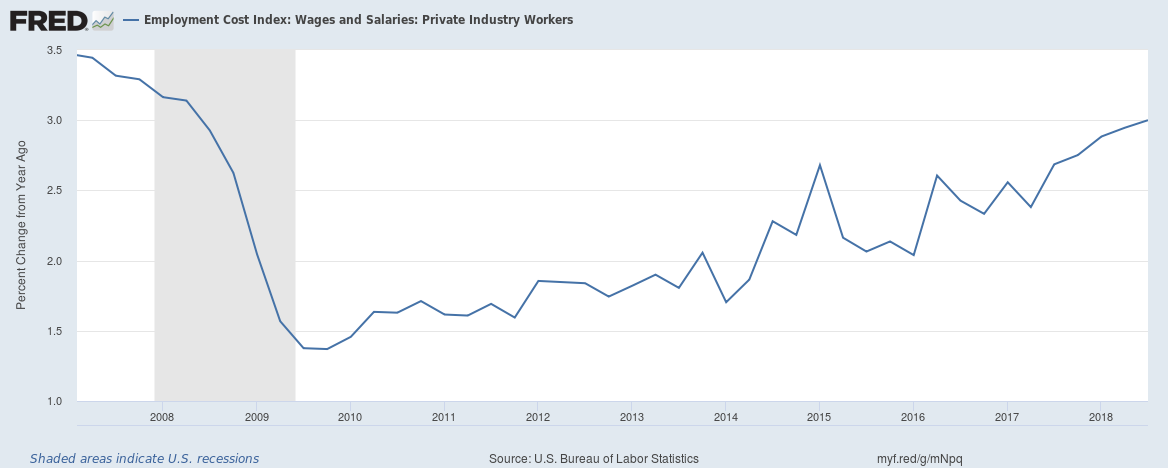

The interesting thing to note is that revenue growth isn't the problem here. While estimates have come down a bit, companies are expected to continue to grow their top line. The big issue is margin pressure. One is wage inflation (see chart below) that is at its highest point since the Great Recession. This is typical of being late in the business cycle. With unemployment very low, wage inflation increases. Furthermore, the China trade tariffs are also pressuring manufacturing firms that have to import goods from the Far East. Because of this, earnings will be flat to slightly down for at least the next three quarters and probably all of 2019. This is not a positive backdrop for stocks in the year ahead so it's data worth tracking.

Photo by Brian McGowan on Unsplash