Therefore as a parent, it is your job to teach your child important financial lessons. According to author Beth Kobliner, children as young as three years old can grasp financial concepts like saving and spending. And a report by researchers at the University of Cambridge revealed that kids' money habits are formed by age 7. The key lesson: start teaching your kids while they are young! Since my daughter Chloe is about to turn 6, I have to make sure she is on the right track.

So here are some tips and tricks to teach your children about money today!

Use the Money Savvy Pig

While piggy banks are a great idea, I love the Money Savvy Pig which is a modern upgrade of a classic. The Money Savvy Pig teaches valuable lessons through a practical and fun method. It features four chambers labeled Save, Spend, Donate and Invest. Since the sides are clear, it is great for visual learning. The kids get excited to see the coins pile up inside over time. Once it is full, you can take it to the bank to trade it in for cash to spend on something special and/or start a savings account.

Show me the money

In today's digital world, it is easy to just spend money with Apple Pay or a credit card so oftentimes kids never see actual cash. This can make it more difficult for kids to grasp the concept of money and they just think you can pull out a magical card to pay for everything. Therefore, I think it is important to “show me the money.” Give them cash to spend so they can better understand that it is a finite resource and there are limits to the amounts. During the summer, if Chloe wants to buy a popsicle at the pool, we give her the a few dollars to buy what she wants. This not only teaches her about money (to pay and collect the change) but also teaches her to be more independent and ask for things on her own.

You have to earn something you want

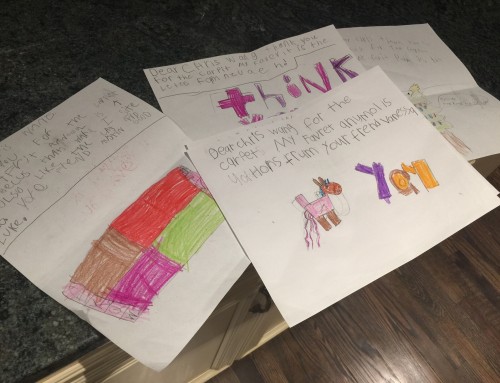

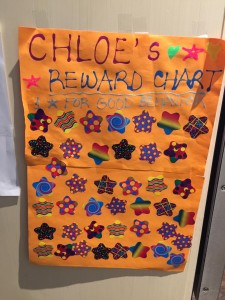

In today's world, we all want instant gratification so this is a lesson that is extremely valuable. Not only do they have to wait to buy something that they want, but they also have to earn it. My daughter saw that her cousins had VTech Kidizoom Smartwatches where you can play games and even take pictures. This wasn't an inexpensive purchase at $60 so we wanted her to earn it. We set up a chart where she could earn stars for doing small chores like cleaning up her playroom or bringing her dishes to the sink. It took her a couple of months but as she grew closer to the 50 stars, she got really excited and would count her stars to see how much further she had to go. In the end, she did earn her watch and she saw the value of her hard work payoff.

Generosity and Donations

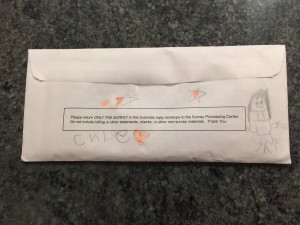

For the past two years for Chloe's birthday, we have asked for donations for her March for Babies walk in lieu of gifts (of course mom and dad and the grandparents still buy her something special). We would much rather have money go to a great cause than to get many gifts that she is likely going to forget in short order. While this idea wasn't hers to start, it has certainly rubbed off on her. Just last week, she filled an envelope of coins and told me that she wanted to donate it to sick kids who don't have money. That made my day for sure!

What tips do you have for teaching kids about money?

“kids money dollar bills tossed” by GoodNCrazy is licensed under CC BY 2.0