The annuity business has grown in popularity as investors, especially those nearing retirement, look for options to protect themselves from stock market volatility and give them a decent income stream in retirement. With over $200 billion in annual sales, the annuity industry is big business with lots of salesmen trying to persuade you to make a purchase.

Today I will dig deep into the Nationwide New Heights annuity which has been requested by several readers. It currently is one of the top 10 best-selling annuities on the market. Sales of indexed annuities, a fixed annuity that provides a minimum guaranteed rate of interest combined with an interest rate tied to the movement of an index, increased to $14.6 billion in the 4th quarter of 2017, a 4.9% gain year over year.

You will often hear that annuities are sold, not bought. This is exactly why I will go in depth into some of the most popular annuities because there is shockingly little information available about them. Most of the information comes from the companies that sell the annuities and they gloss over the fees, risks and downsides. More importantly, annuities have grown into extremely complex instruments which even the most seasoned professional may have trouble deciphering. Indexed annuities, often the black sheep of retirement products, have a history of being so complex that they were a focal point of litigation and regulatory action in the 2000s. Insurers paid millions in fines. While the negative attention led to a change for the better among the carriers, indexed annuities are still complex and difficult to truly understand for many investors.

It is of the utmost importance to make an informed decision. I have dealt with too many clients that have come to me asking for help getting out of an annuity and I can’t help after the fact. Stiff surrender penalties can’t be avoided for many years after you sign on the dotted line.

Perspective That You Can Trust

I am writing this blog from the perspective of a curious analyst. I am totally impartial as I am a fee-only registered investment advisor. I hope to bring a unique perspective to this topic drawing on my years of experience analyzing companies as a research analyst. I’ve met with hundreds of company CEOs and CFOs, including Steve Jobs and Richard Branson, and I will use my analytical skills to break down these complex instruments into something easier to understand.

While many investment professionals hate annuities, I do not believe that they are all bad and some of them can make sense as a small part of your investment portfolio. Annuities should never, I repeat never, be the large majority of your portfolio because of their lack of liquidity which is one of their biggest drawbacks.

Issuer Review: Nationwide Mutual Insurance

It is important to look at the issuer of the annuity first because annuities are NOT a guaranteed investment of any sort. This is important to note so I will say it one more time. Annuities are NOT guaranteed. They are only backed by the ability of the issuing insurance company’s ability to pay. Therefore if the issuer goes bankrupt, you are at risk of losing everything! States provide differing levels of protection but they are not funded reserves like FDIC insurance.

Nationwide Mutual Insurance is based in Columbus, OH and is ranked #68 in the most recent Fortune 500. Once a public company, Nationwide Financial Services was repurchased by Nationwide Mutual in 2009, which had owned the majority of NFS stock since it went public in 1997.

Nationwide receives sterling ratings by credit agencies. It is rated A+ by A.M. Best and S&P and A1 by Moody's.

Annuity Review: Nationwide New Heights 12

This annuity comes in 4 flavors with the Nationwide New Heights 8, Nationwide New Heights 9, Nationwide New Heights 10 and Nationwide New Heights 12. The number refers to the length of the surrender period so New Heights 8 has a surrender period of 8 years; while the New Heights 12 has the longest surrender period of 12 years. Today I will focus on the Nationwide New Heights 12, but you can find more information about each annuity at Nationwide.com.

Maximum age for initial purchase: 75

Minimum initial premium: $25,000

High Point 365 Lifetime Benefit Rider: 0.95%-1.25% per year

High Point Enhanced Death Benefit Rider: 0.55% per year

Website: www.nationwide.com

Beware of Surrender Fees

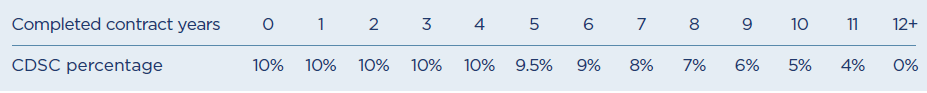

Surrender charges and period for this annuity are typical of most indexed annuities; however, Nationwide has decided against calling them surrender charges and instead names it Contingent Deferred Sales Charge (CDSC). For the Nationwide New Heights 12, surrender fees go for 12 years and are 10% for the first 5 years!

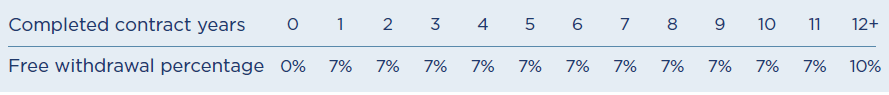

With this annuity, you can make penalty free withdrawals of up to 7% of the greater of your New Heights 12 required minimum distribution or your contract value on the first day of the contract year times your free withdrawal percentage. Here are the free withdrawal percentages.

I believe surrender fees or CDSC are one of the worst features of annuities. These are huge lockup fees and if you need the money, they sock it to you. This is why annuities should NEVER be a significant part of your investment portfolio because they are essentially illiquid for many years. Unless you are positive you will not need access to these funds, then annuities are NOT for you.

The Nationwide pitch as per their brochure

Nationwide highlights these points:

- Enhanced growth potential

- Protection from market risk

- Flexibility and transparency

How will you likely be pitched this annuity?

This indexed annuity (also called an equity-indexed annuity, fixed-index annuity or hybrid annuity) will likely be packaged around two main components:

1. Principle protection with upside potential from their index choices

2. Lifetime income withdrawal options with the High Point 365 rider

Let's dig into this annuity so you have a better understanding of the nuts and bolts…

Strategy Earning Options

It is important to understand that you are not investing in the underlying securities of any index. With index annuities, you are not making investment choices like a variable annuity. Your interest crediting options or here strategy earning options are mathematical formulas that the insurance company is using to attract you into buying xyz annuity. The insurance company invests your money in whatever they choose (likely diversified, conservative investments). They just have to earn a return higher than their mathematical formula (or interest crediting option) so they can pay you, their sales force, marketing, operations, etc. This is why index annuities will only generate low single-digit returns in the current market environment.

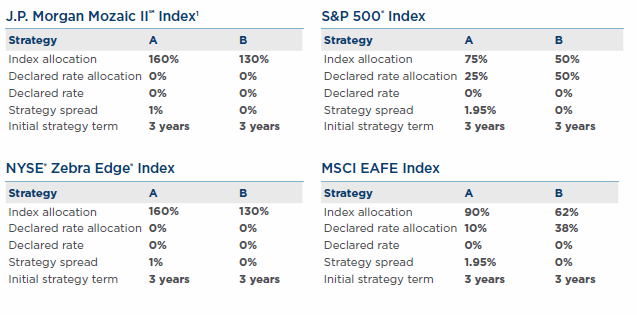

For the Nationwide New Heights 12 Annuity, you may select from 4 different strategies: JP Morgan Mozaic II Index, NYSE Zebra Edge Index, S&P 500 Index and MSCI EAFE Index. So let's dig a bit deeper into your choices.

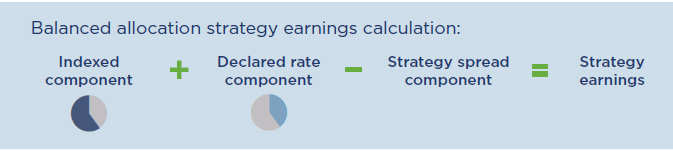

Within each strategy option, the strategy earnings are determined by adding the growth in the indexed component to the declared rate component, then subtracting the strategy spread component. That is a mouthful and yes adds to the complexity. Hopefully, you are good at math and can understand how your earnings are calculated. Furthermore, the current declared rate is zero for all strategies so you are adding zero there.

Here is the current rate sheet as of June 2018. Check for your state's rates at Nationwide as they may differ.

The JP Morgan Mozaic II Index went live on December 28, 2016 and the NYSE Zebra Edge Index went live on October 1, 2016. I am skeptical of newly created indices because they are often paraded out because they have great backtested results, but often fall short in the real world. Doesn't it make you wonder what happened to the first iteration of the Mozaic index?

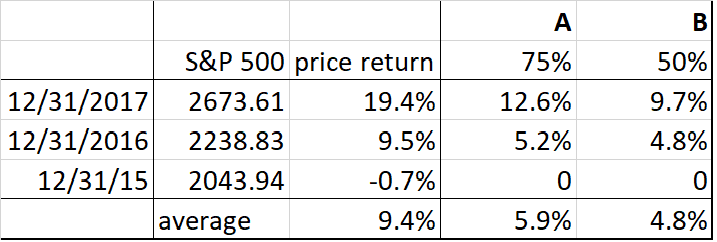

Here is what the S&P 500 returns would have been for the past 3 years at current rates. Keep in mind that rates change over time so you wouldn't have been able to get the same contract rates in 2015.

If you went with S&P Strategy A, you would have a very healthy 5.9% return but that drops to below 4% after you subtract out the spread. Strategy B would have returned 4.8%. These are very respectable even though the actual S&P returned over 11% with dividends. But if this annuity produces close to 5% returns over the long-term, then you should be extremely happy. I'm skeptical but I can't rule it out either.

Remember with all choices, Nationwide can change the formulas after 3 years so that makes it even more challenging to forecast returns. Furthermore, if you go with either of the additional riders, it will come at an additional cost which will eat into your returns.

If you have additional questions about these options, please submit a question using our secure form. We will answer your questions within 24 hours via email. No strings attached, just a little free help to point you in the right direction.

Who should buy this product?

In summary, the Nationwide New Heights 12 Annuity is something to consider for someone that doesn't want to worry about market volatility, wants a guaranteed income stream and is happy with single-digit returns of roughly 2-5% which all indexed annuities will return. If you are happy with low investment returns and a guaranteed income stream, then this product may be acceptable for you. Index annuities should be thought of as a fixed income substitute and don't buy the dream that these will produce equity returns with no downside risk. Given the liquidity issues, you should limit your exposure to annuities to roughly 25% of your overall portfolio if you decide to buy one.

This product will work best for those that are in good health and have a family history of longevity. If you can live to your late 90s, then the guaranteed income stream will pay off handsomely. Just keep in mind that the income payments first come out of your principal and after your account value goes to zero, then you start earning a return. For most of us that live an average lifespan or even into your 80s, then a conservative portfolio of stocks and bonds will likely be a better choice. Be sure to evaluate how it fits into your entire investment strategy and how it will help you reach your financial goals.

Don't buy into any sales pitch that is promising rates of return of 8% or more. It just isn't possible to generate high returns with no downside risk. If anyone promises big returns for this annuity, don't just walk away, run for the door and find a new advisor. For Nationwide to pay 8% on this annuity, they would have to earn 9-10%+ on their own investment portfolio so they could pay you as well as their salespeople, marketing and overhead, not to mention to earn a profit themselves. Commissions are very lucrative for agents selling this annuity (as much as 7%) so be sure that you make the right decision for you, not for their benefit.

Have questions about this Annuity?

If you're considering this annuity and have additional questions, feel free to reach out. You can contact us via our secure contact form. We will answer your questions within 24 hours via email. No strings attached, just a little free help to point you in the right direction.

Please share your research and experience in the comments section below.