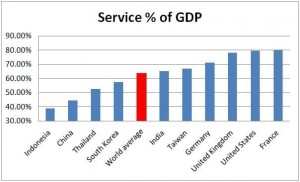

According to Bloomberg, the service sector in Asian emerging markets is poised to exceed 50% for the first time. This is a historic milestone as Asia shifts its role as the world’s manufacturing partner to developing self sufficient domestic growth via its service sector. China’s 12th 5-year plan lays out specific guidelines and incentives to create the environment necessary for extensive development in the service sector. In 2012, China’s service sector accounted for just 44.6% of GDP vs the world average of 63.6% so there is huge room for growth.

Source: IMF

Both domestic and international companies are scrambling to serve the rising demand in the region. Ernst and Young forecasts that two-thirds of the world’s middle class will reside in theAsia-Pacific by 2030. These new consumers will be spending more on eating out, education, healthcare and travel. Chinese are already the world's biggest spenders on international tourism. They spent $102 billion in 2012 – a 40% increase over 2011! Retail sales in Asia-Pacific will be worth about $11.8 trillion by 2016, compared with $4.4 trillion for North America and $3.1 trillion for Western Europe, PricewaterhouseCoopers LLP said in a January report. These are staggering numbers which provide great opportunity for savvy investors.

What makes service companies a compelling investment?

Besides the macro trend of service growth in Asia, service companies have many attractive investment characteristics in their own right. In our extensive research and analysis, most service companies have recurring revenue models, low churn, less need for debt, are more stable/less cyclical and are highly scalable. Our research shows that investing in service companies results in less volatility and superior performance in the long run. While our investments have focused mainly on US companies, we see no reason why service companies in Asia wouldn’t provide the same attractive characteristics as the US.

So how do you take advantage of this trend? Invest in Chinese service companies!

The Chinese government has spelled it out for everyone in their current 5-year plan that they are shifting their focus to service sector growth so as an investor you should follow the leader. Their plan states very clearly that they will accelerate the development of production services which includes financial services, logistics, high tech services and business services. They also plan on vigorously developing the life services industry which includes supermarkets, tourism, restaurants, healthcare and nursing services. These sectors will get the benefit of government policy and incentives to grow over the next several years.

One way to participate in this growth is by investing in US service companies with exposure to China. Yum Brands, owners of KFC, Taco Bell and Pizza Hut franchises, is the poster child for a company aggressively expanding and profiting from Asian consumers. In 2012, Yum Brands had over 5,600 restaurants in China with over $8 billion in sales and $1 billion in operating profit. Yum is so bullish on growth prospects in China that they accelerated new unit growth from 656 units in 2011 to over 800 new units and 300 remodels in 2012.

Another investment choice is to invest in ADRs of Chinese companies. This is the pure play approach with most of these firms deriving 100% of their sales and profits from China. In recent years, some people have questioned Chinese accounting practices but many of these businesses have executives with years of experience with the largest multinational corporations and many have their financials audited by the big four accounting firms.

The Shanghai Composite is down over 7% year-to-date and headlines have focused on slowing GDP growth to 7%, but Chinese ADRs have propelled higher on US exchanges. Unsurprisingly, the majority of the best performers have been service companies while the laggards have been manufacturing firms. See the chart below with service industries in bold.

Chinese ADRs have had an amazing year in 2013. The average return of 194 ADRs is 31% through September 5th – far outpacing the S&P 500 return of 16%.

The final alternative is investing in Chinese exchange traded funds or ETFs. These give investors broader market exposure. Some choices are iShares FTSE China 25 Index Fund (FXI) and SPDR S&P China ETF (GXC). The problem with these ETFs is that they own mostly quasi-government corporations and more importantly many are not service companies. Two better alternatives are Global X China Consumer ETF (CHIQ) and the new kid on the block, KraneShares CSI China Five Year Plan ETF (KFYP). KraneShares is unique as it carries a Beijing presence and its Chinese partners position it to provide ETF strategies from a Chinese perspective.

In the end treat your Asian investment as you would any other. You have to do your homework, follow your instincts and be sure to invest in highest quality companies. If you can’t do it yourself, look for a registered investment advisor that has experience and the know how to invest in the service sector.

By