Today marks the 30th anniversary of Black Monday where the Dow Jones Industrial Average crashed 23%, the worst one day drop in stock market history. This afternoon, I had lunch with eight money managers that lived through it and they remember it like it was yesterday. One was working at a DLJ trading desk and he said that there were no buyers and as the market fell, their solution was to not pick up the phone. Another stated that it was so horrific that the only thought was to enjoy dinner while their credit cards still worked. They feared that the job losses would be enormous. Then it was my father Sam‘s turn to speak. He was managing the Bank of New York's pension assets and other institutions like the Dow Jones profit sharing plan. He had seen the writing on the wall in August of 1987. I recall that we were on vacation in Switzerland and he went to the front desk of the hotel to get his valuation runs which were faxed over from New York. Because interest rates were rising quickly, valuations moved from fairly valued to grossly overvalued and he made the critical decision to start selling. In the November 2, 1987 issue of Barron's quoted Sam saying, “I raised about 20% cash in the first two weeks of August. At that point, there were a great number of signs pointing to an imminent bear market… and by the end of August, my institutional accounts already went to 35% cash, and individual accounts went to about 55% cash.” His economic model was spot on and not only was it right, but he took decisive action and made the bold call to move to cash when the market was still up over 40% for the year and hitting new highs.

Is a 1987 crash imminent?

Does Sam think this is similar to 1987 and is a crash near? The answer is flat out no. Today's market doesn't resemble 1987 in any way and he says that he sees little sign of danger at this point. In 1987, inflation rose from 1% to 4% in a matter of months and interest rates followed suit. The 30-year Treasury rose from 7.5% in March to 9% in May and spiked to over 10% in the days leading up to Black Monday. Today inflation is barely approaching 2% and long-term interest rates are at 2.88%. In Switzerland, a 50-year government bond pays just 0.48%. With the choice between bonds and cash paying almost nothing, investors are being forced into the equity markets to look for returns. With a strong economy and corporate profitability, the best option is most definitely stocks.

Could there be a repeat of 1987 in the future? Of course. If rates jumped 2% in a couple of months like 1987, valuations wouldn't look as attractive anymore. However with central banks in Europe in Japan still printing billions on a monthly basis, long term rates are likely to stay lower for longer. There will be another bear market someday and it could be a significant one because the Fed has little ammo left to fight off a recession. But for now, we think the skies are clear and we are happy to see the market hitting record highs.

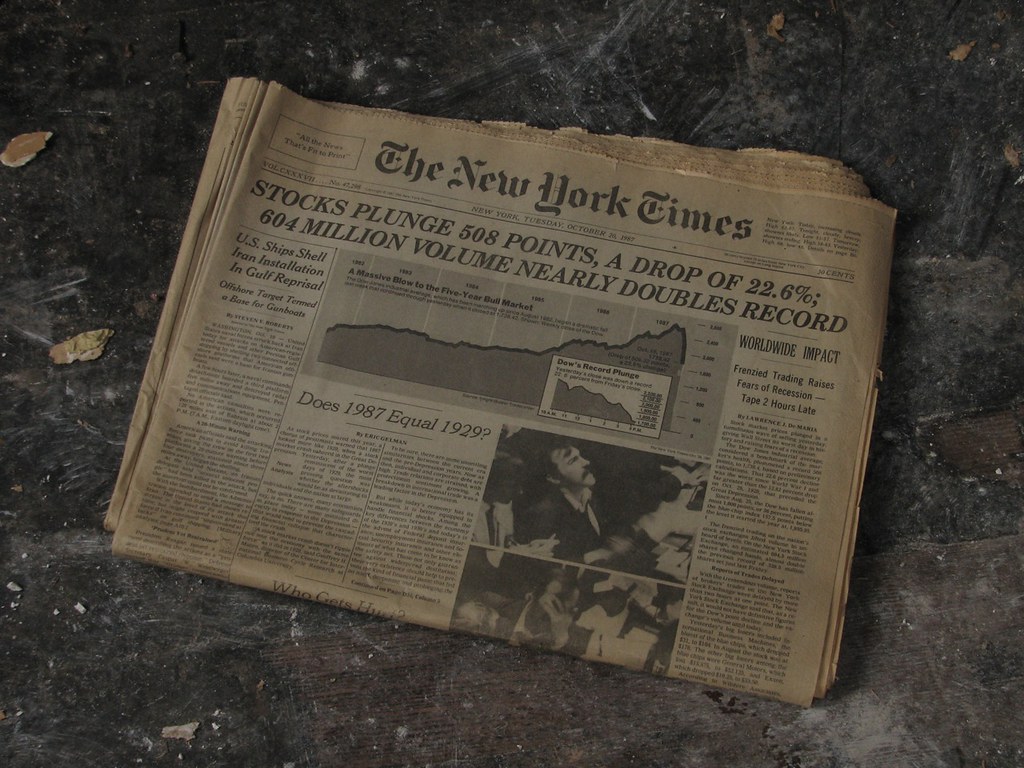

“Black Monday” by Usonian is licensed under CC BY-NC-SA 2.0