.

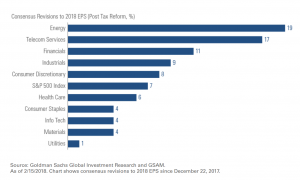

Domestic sectors that pay close to 35% tax rates stand to benefit the most in 2018. As you can see from the chart above, telecom, energy and financials are seeing the biggest revisions. Meanwhile sectors with lower effective tax rates like technology are seeing smaller revisions but they are still positive nonetheless.

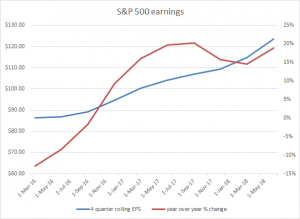

As you can see in the chart above, S&P 500 earnings are very healthy growing 16% in 2017. In addition, earnings are expected to re-accelerate in 2018 as tax reform starts to hit individual's paychecks and corporations see more profits hit the bottom line. While volatility has picked up a bit in the first couple of months, we still see strong global economic growth and S&P earnings growth giving the stock market bullish tailwinds for the year ahead. Cisco's Chief Executive Officer Chuck Robbins said, “Clearly the economy is encouraging. There’s a lot of optimism.” We are wary of recent tariff talk as a potential negative, however, it is premature to take action on what may or may not occur. For now, investors should stay bullish.

“Bull Market” by investmentzen is licensed under CC BY 2.0