The annuity business has grown in popularity as investors, especially those nearing retirement, look for options to protect themselves from stock market volatility and give them a decent income stream in retirement. With over $200 billion in annual sales, the annuity industry is big business with lots of salesmen trying to persuade you to make a purchase.

Today I will dig deep into the Global Atlantic SecureFore 3 annuity which has been requested by several readers. It currently is one of the top 10 best-selling annuities on the market. This is our first review of a fixed annuity as our previous reviews were for indexed and variable annuities. Fixed annuities are more straightforward and less complex so this should be shorter than our typical review.

You will often hear that annuities are sold, not bought. This is exactly why I will go in depth into some of the most popular annuities because there is shockingly little information available about them. Most of the information comes from the companies that sell the annuities and they gloss over the fees, risks and downsides. More importantly, annuities have grown into extremely complex instruments which even the most seasoned professional may have trouble deciphering. It is of the utmost importance to make an informed decision. I have dealt with too many clients that have come to me asking for help getting out of an annuity and I can’t help after the fact. Stiff surrender penalties can’t be avoided for many years after you sign on the dotted line.

Perspective That You Can Trust

I am writing this blog from the perspective as a curious analyst. I am totally impartial as I am a fee-only registered investment advisor. I hope to bring a unique perspective to this topic drawing on my years of experience analyzing companies as a research analyst. I’ve met with hundreds of company CEOs and CFOs, including Steve Jobs and Richard Branson, and I will use my analytical skills to break down these complex instruments into something easier to understand.

While many investment professionals hate annuities, I do not believe that they are all bad and some of them can make sense as a small part of your investment portfolio. Annuities should never, I repeat never, be the large majority of your portfolio because of their lack of liquidity which is one of their biggest drawbacks.

Issuer Review: Global Atlantic

It is important to look at the issuer of the annuity first because annuities are NOT a guaranteed investment of any sort. This is important to note so I will say it one more time. Annuities are NOT guaranteed. They are only backed by the ability of the issuing insurance company’s ability to pay. Therefore if the issuer goes bankrupt, you are at risk of losing everything! States provide differing levels of protection but they are not funded reserves like FDIC insurance.

Global Atlantic Financial Group is a privately held company. With approximately 1,500 shareholders, the ownership is comprised of management, employees, individuals and institutions. Global Atlantic has over $50 billion in assets at the holding company level. The SecureFore annuities are issued by their subsidiary Forethought Life Insurance Company which has $24.9 billion in assets. Forethought Life Insurance is rated A- by A.M. Best and S&P. It is rated Aa3 by Moody's.

Annuity Review: Global Atlantic SecureFore 3

This annuity comes in 3 flavors with the SecureFore 3, the SecureFore 5 and the SecureFore 7. The number refers to the length of the surrender period and interest rate guarantee so SecureFore 3 has a surrender period of 3 years.

Maximum age for initial purchase: 85

Single Premium

Minimum initial premium: $10,000

Website: www.globalatlantic.com

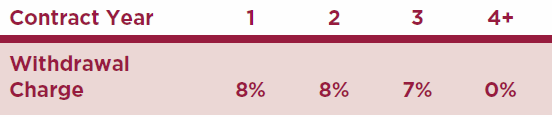

Beware of Surrender Fees

Surrender charges and period for this annuity last for 3 years and are as follows.

I believe surrender fees are one of the worst features of annuities. These are huge lockup fees and if you need the money, they sock it to you. This is why annuities should NEVER be a significant part of your investment portfolio because they lack liquidity when compared to bonds. Unless you are positive you will not need access to these funds, then annuities are NOT for you.

Note that after your first contract year, you are able to make 10% penalty-free withdrawals.

The marketing brochure

Global Atlantic highlights these points:

- Guaranteed growth

- Tax-deferral

- Principal protection

How will you likely be pitched this annuity?

Your agent will likely focus on:

- principal protection: the money is 100% guaranteed if held to the end of the 3 years

- guaranteed return: the current interest rate on this annuity is 2.75%

- terminal illness and nursing home waiver: if you enter a nursing home or are diagnosed with a terminal illness after first contract anniversary, then you can withdraw from the annuity penalty free

- tax deferral – you only pay taxes on your interest earnings when you take withdrawals or income payouts

If you have additional questions about these options, please submit a question using our secure form. We will answer your questions within 24 hours via email. No strings attached, just a little free help to point you in the right direction.

Fees/Commissions

No fees are deducted from your account unless you take a withdrawal that is subject to surrender fees. However, that doesn't mean that this is a free product.

Keep in mind that your agent is earning a commission on this annuity of 0.90% if you are 81-85 and 1.8% if you are 0-80. They are clearly incentivized to sell you an annuity over a bond which in my opinion can generate similar or greater returns and with better liquidity.

The Runnymede assessment

In summary, the SecureFore 3 fixed annuity is pretty straightforward as you are guaranteed a 2.75% rate (as of June 2018) for 3 years. After the five years, the rate is set on an annual basis so you can either accept it or surrender your policy. The minimum rate guarantee after the 5 years is 0.50%. This is basically a fixed income (aka bond) substitute so as long as you are using it as a safe part of your portfolio, then it will be ok. Just be sure that you won't need the assets above 10% per year or you will be subject to surrender fees and you don't want to trigger those.

For most people, this can work as part of a “bond” ladder or part of your portfolio that you want extremely conservative. Given that interest rates are on the rise, you may be able to get similar rates on Treasury bonds in the next 12 months. Personally, I don't see the benefits of choosing an annuity over bonds. Today, you can buy a 3-year Baidu bond (rated A3 by Moody's) and it yields 3.1%. Not only does it yield more but you have 100% liquidity.

Thanks for sticking with me on this annuity review. I learned a lot in my research process and I hope you are able to make a more informed investment decision because of it. Please don’t let your agent pressure you into a sale before you have made an informed decision. Since annuities lock you into a long-term contract with stiff surrender fees, please be sure to take your time to make the best possible decision for you and your family.

Have questions about this Annuity?

If you're considering this annuity and have additional questions, feel free to reach out. You can contact us via our secure contact form. We will answer your questions within 24 hours via email. No strings attached, just a little free help to point you in the right direction.

Please share your experiences in the comments section below.